Les Marioles de la BCE ont publié dimanche 26 octobre les résultats de leurs tests portant sur les grandes banques de l’Union Européenne : tout va bien ! Évidemment…

Evidemment, tous les idiots nuisibles, c’est-à-dire les journaleux et les bonimenteurs dans le genre analystes et stratégistes (et pas uniquement ceux de Natixis !) ont applaudi et prédit une hausse des cours des banques dès le lundi.

Une fois de plus, les Marioles de la BCE se sont ridiculisés, ainsi que tous ces idiots.

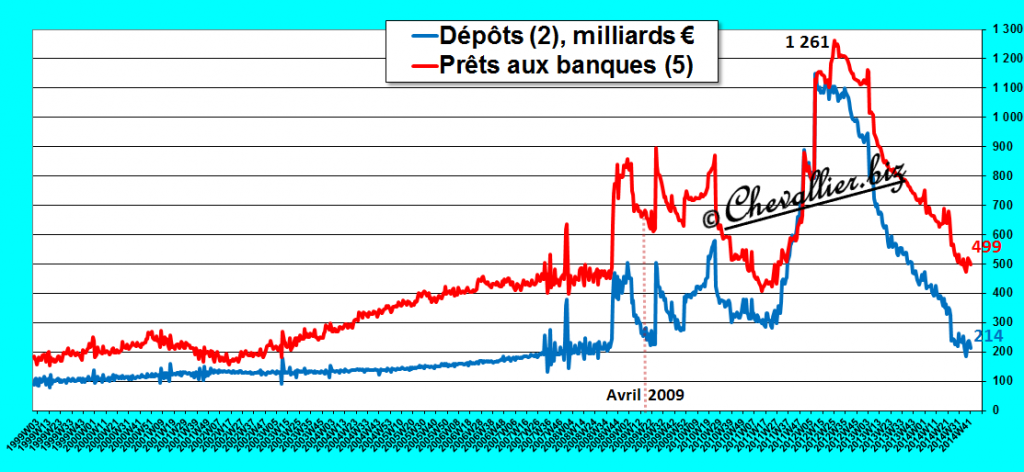

Comme je l’ai écrit maintes fois, rien ne va plus dans le secteur bancaire européen, en particulier dans la zone euro comme le montre le bilan de la BCE : les banques empruntent environ 500 milliards d’euros à la BCE et elles s’empressent de placer 214 milliards à la BCE !

Document 1 :

… car les dirigeants des banques savent que beaucoup de banques ne sont pas fiables.

En effet, ils ne veulent pas prêter leurs disponibilités à d’autres banques car ils craignent de ne pas pouvoir les récupérer. Seuls les Marioles de la BCE sont assez fous pour leur prêter 500 milliards d’euros !

Normalement, quand un système bancaire est solide et fiable, les banques qui ont des disponibilités les prêtent à celles qui en manquent, ce qui ne se fait plus car dans la zone euro, le système bancaire est complètement bloqué, inexistant.

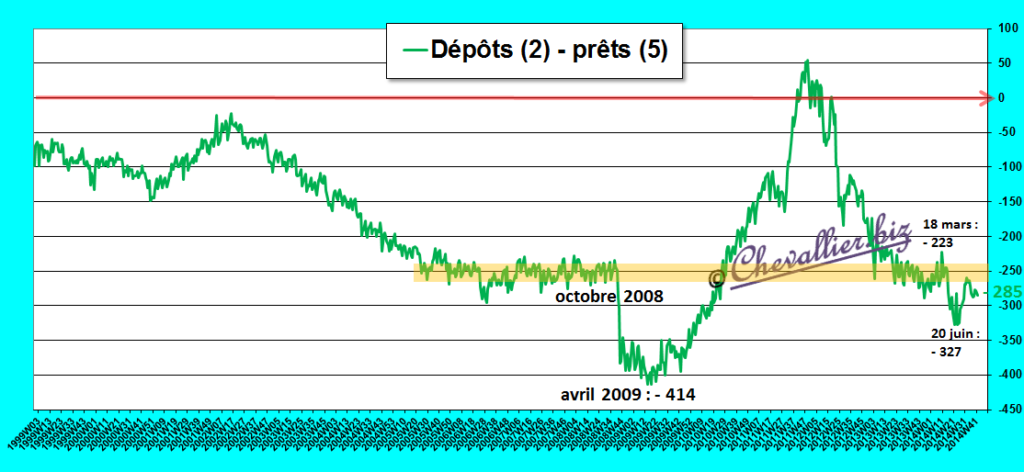

L’écart entre les prêts et les dépôts est très important (285 milliards !) et la situation peut s’aggraver très rapidement,

Document 2 :

Pour l’instant, tout va bien : pas de tsunami bancaire.

Tout est simple.

Financial Times: Alternative stress tests find French banks are weakest in Europe

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email [email protected] to buy additional rights.

On Sunday, Christian Noyer, governor of the Banque de France, was crowing about the “excellent” performance of French banks on the European stress tests

Many of their Italian and Greek counterparts might have flunked but France could be proud of its banking sector. “The French banks are in the best positions in the eurozone,” said Mr Noyer.

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email [email protected] to buy additional rights.

Not so fast.

Two days earlier, a different test found that the French financial sector was the weakest in Europe.

The team with the temerity to deliver this bucket of cold water to Paris works at the wonderfully named Volatility Institute at New York University’s Stern school and presented its findings from a safe distance – a financial conference at the University of Michigan.

The chief architect, Viral Acharya, has worked on systemic risk ever since the last crisis, attempting to design a bank safety test that can be run all the time – not at the whim of regulators.

Using his methodology, which he calls SRISK, Mr Acharya found that in a crisis French financial institutions would have a capital shortfall of almost $400bn, worse than the US and UK despite their much bigger financial sectors. Looking just at the French banks tested in the ECB stress tests, which found zero capital shortfall, SRISK came up with €189bn.

Mr Acharya did not have access to the 6,000 officials who scoured balance sheets across Europe to gauge the health of the continent’s banks.

But his results, which have implications for other countries, including China, should not be ignored.

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email [email protected] to buy additional rights.

Take Société Générale. France’s second-biggest bank by market value did fine on the ECB’s stress test. But on Mr Acharya’s measure, the bank has a large capital shortfall in a crisis.

There are a couple of big reasons for the difference. First, SRISK takes into account the banks’ total balance sheet without regard for risk: unlike the ECB, it does not attempt to distinguish between €1m of German Bunds and a €1m loan to a dipsomaniac farmer with a rusty tractor.

Second, it does not care what banks’ book value of equity is; it uses what the stock market says it is. Under the ECB’s methodology, SocGen has €36.6bn of equity today and, in a crisis, would have €30.7bn of equity against €377bn of risk-weighted assets. That equates to a passable 8.1 per cent capital ratio even in a deep recession.

According to Mr Acharya’s methodology, the bank has only €30bn of market equity today against €1,322bn of assets for a much weaker capital ratio of 2.3 per cent. In a crisis, when market values would plunge further, SocGen would be left with a shortfall of more than €60bn.*

Using the stock market to compute a bank’s equity makes SRISK vulnerable to irrational optimism or irrational pessimism of investors. But Mr Acharya finds three good reasons to use it. “Markets told us that subprime MBS [mortgage-backed securities] had become poor in quality and liquidity; book values and regulatory risk weights did not,” he says. “Market values are also harder to manipulate by management through understatement of losses or provisions. Finally, banking crises are caused by drying up of credit by financiers. Financiers are not interested in book values or regulatory capital per se, but whether the firm can raise capital if needed to repay them. This is best captured by market value.”

It is not just France’s regulators and banks that might be well-advised to stop patting themselves on the back and consider other measures of systemic risk. Europe’s aggregate SRISK has fallen since 2011, with the deleveraging of balance sheets following the eurozone crisis. Systemic risk in the US has also fallen by half since 2008. But risk in China has picked up significantly and now surpasses the US. If anything, Mr Acharya notes, the problem is likely to be understated because of the amounts of off-balance sheet debt in China. In the US, JPMorgan Chase’s leverage might be much better than its French counterparts, but its SRISK is bigger: a $98.4bn shortfall in a crisis. MetLife, which is considering suing the US government over its designation as a systemically important company, is found to pose a bigger systemic risk than Goldman Sachs.

If you believe that financial companies always appropriately value their assets and never try to massage the value of their equity and if you believe that officials are always diligent in examining banks’ accounting then SRISK is a waste of time. But if you believe this you haven’t been paying attention for the last decade.

http://www.ft.com/intl/cms/s/0/fad2c772-5dd7-11e4-b7a2-00144feabdc0.html#axzz3HKu5YEuZ

Deux « hommages » appuyes au maitre de lieux 🙂

Dans le Monde:

http://www.lemonde.fr/idees/article/2014/10/28/secteur-bancaire-tout-va-tres-bien-madame-la-marquise_4513741_3232.html

Sur le site de l’institut des libertes:

http://institutdeslibertes.org/tests-de-solvabilite-la-grande-tartuferie/

Ils sont bien jeunes ces deux economistes… surtout notre etudiant de l’institut des libertes

Mais quand on voit que le plus grand economiste de France, que la Terre , que dis-je que l Univers nous envie, se laisse embarquer dans des affaires foireuses, on se prend a rever de renouvellement. 😀

http://www.lefigaro.fr/societes/2014/10/28/20005-20141028ARTFIG00125-le-fonds-de-dsk-en-difficultes-financieres.php

Bonne journee a tous

Stef du Canada