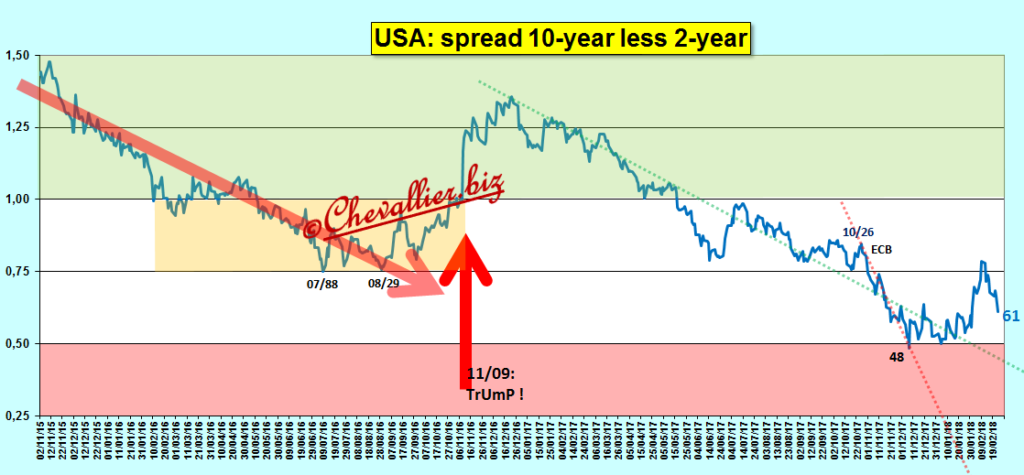

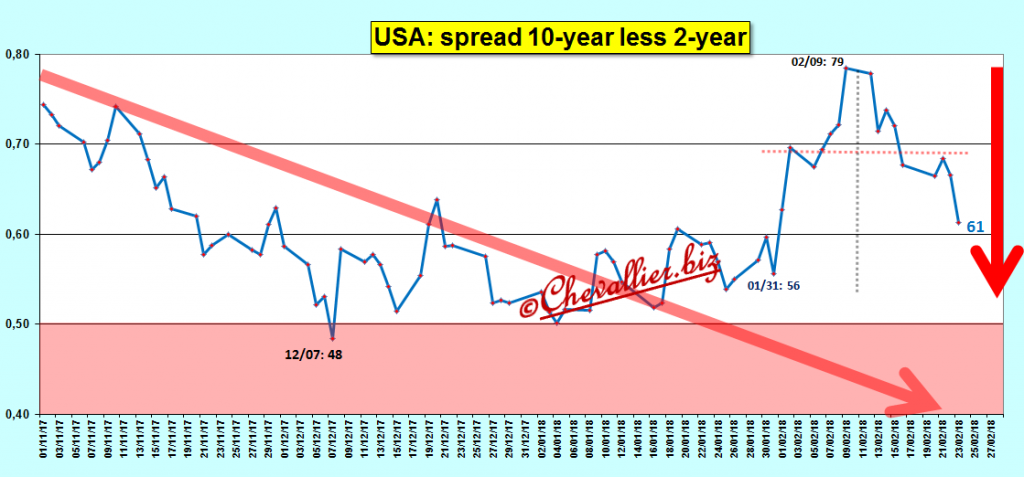

The curve representing the difference between the yields of 10-year Notes and those of 2-year Notes reveals in technical analysis in February a very beautiful head on his shoulders with a well-drawn choker,

Document 1:

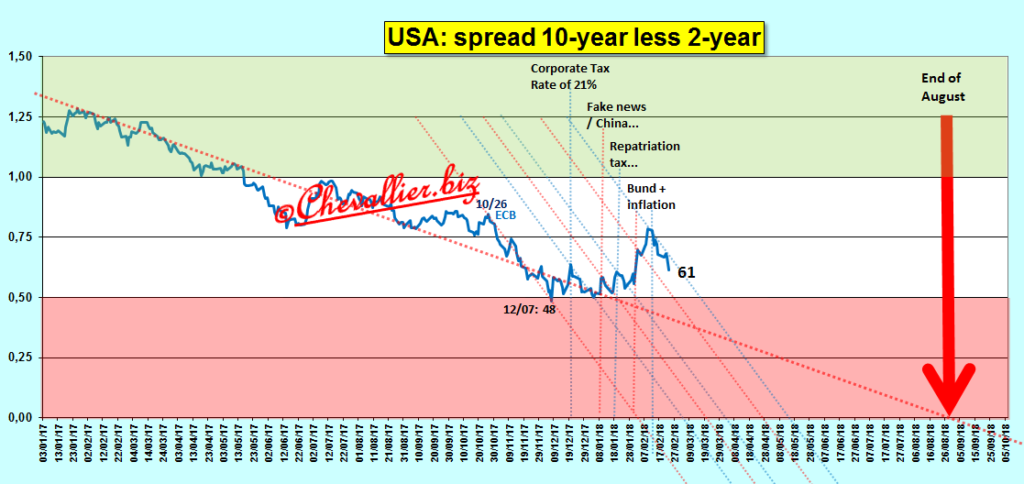

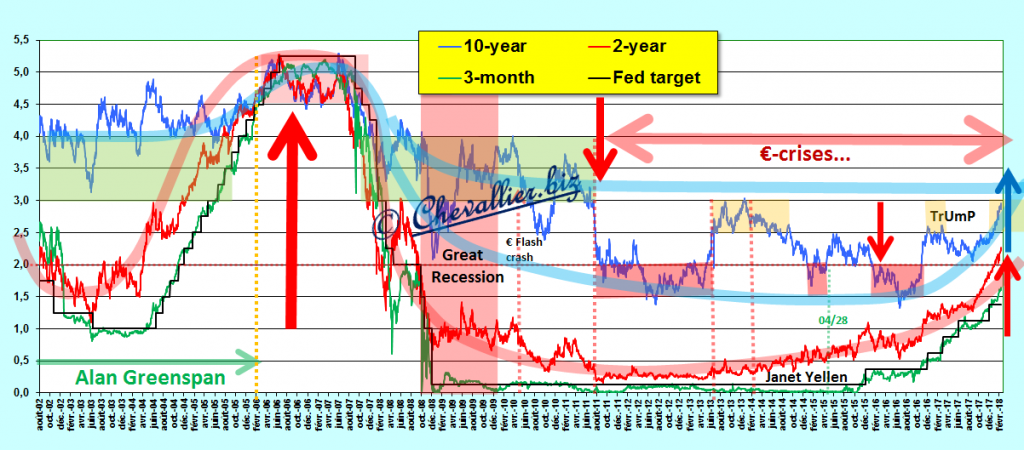

A zoom out shows that the fake news from nomenklatura of the euro-zone delay the long and heavy trend of the decline of this gap…

Document 2:

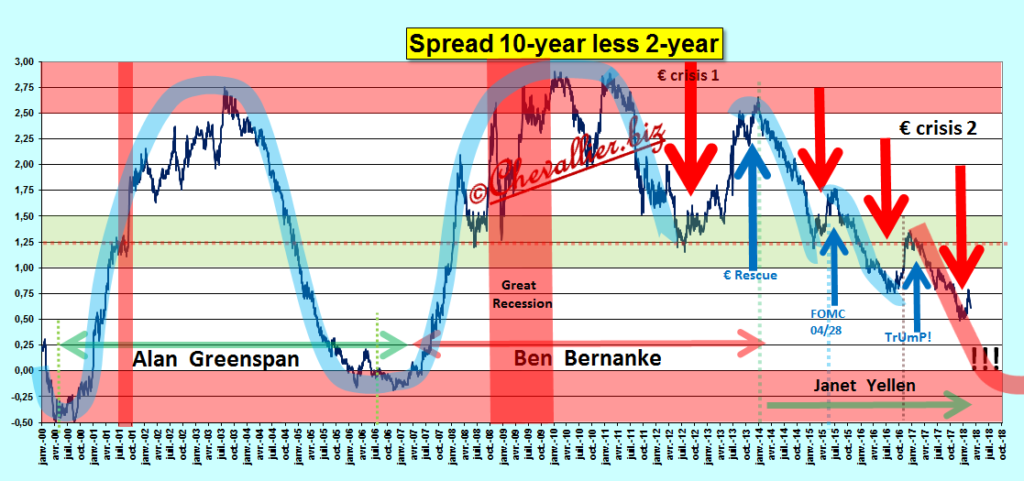

… which is part of a down cycle started in the summer of 2011 by the €-crisis…

Document 3:

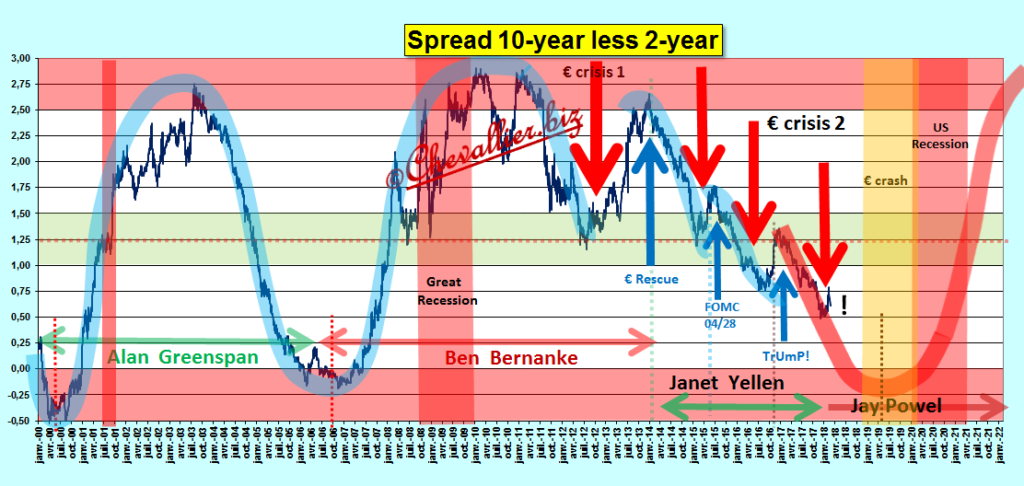

… that will lead to a €-crash and then a recession in the United States,

Document 4:

Zoom in on this curve for more details,

Document 5:

After the euphoria of the FOMC stimulus and Donald Trump’s policy, the 10-year Notes returns will return to below the 2-year Notes.

The inverted yield curve will precede a US recession caused by the €-crash,

Document 6:

For now, everything is okay. The sea is calm, the sun shines, as always before a tsunami.