Many banks in the euro zone have a real leverage at 30 to 50! They cannot withstand the large current financial turmoil.

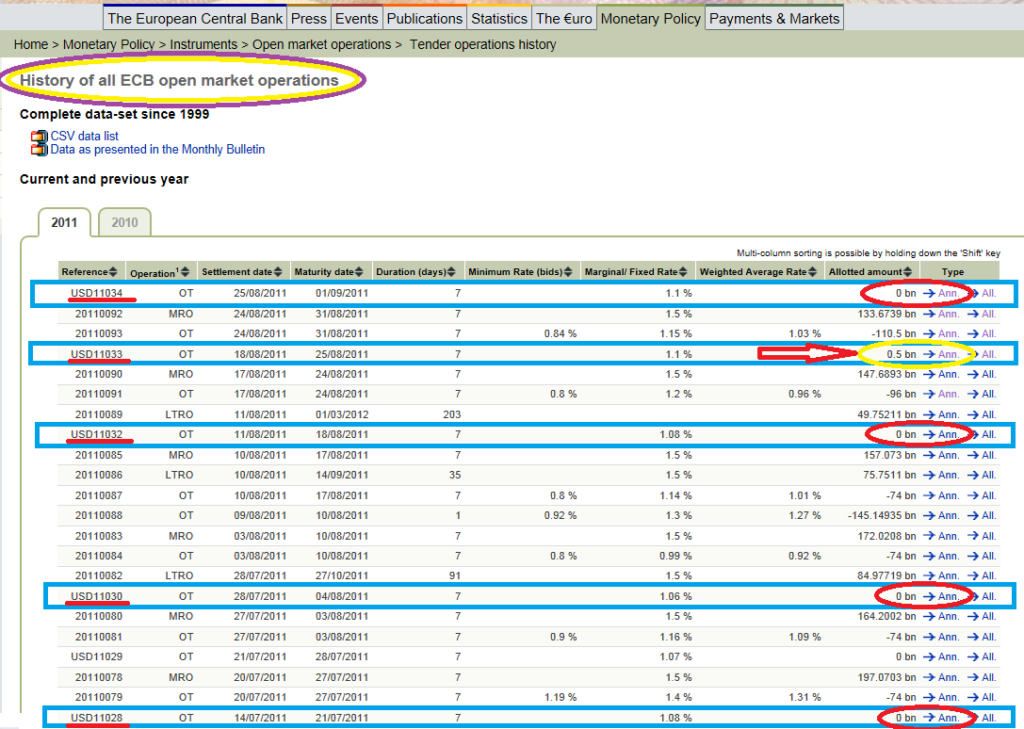

August 18, a bank has even been forced to borrow $500 million to the ECB for a period of seven days to avoid being in default according to the ECB.

August 25, at maturity, this bank has had difficulties to repay the loan and had to sell assets in panic but it was not the only one with these problems.

In early U.S trading, the DAX index fell 5% from its level in the early morning in Europe: Sidharth Chaubey relates (in comments of my blog) that the amount of trade was €7.25 billion for a quarter of an hour based on information from Bloomberg.

Conflicting reports circulated about this unusual drop in prices. In such circumstances, the most serious is that neither banks nor authorities publish pertinent information, leading to persistent rumors and misinterpretations.

I interpreted the announcement of the ECB 11,034 as a loan application (as the previous week to 11,033) which was not finally allocated, which does not correspond to reality …

Stanislas Jourdan and other readers of my blog have well noted that this was a normal announcement of the ECB, which makes it possible for banks who may be in default currency to lend (for a minimum of $5 million) in provisions that were taken after the bankruptcy of Lehman Brothers,

Click here to access the ECB on the history of these ads.

The main problem is there: many (small and large) banks in the euro zone are in survival state. A bank tsunami preceded by flash crash is developing because the fundamentals of the banks in the euro zone zone are bad. Anything can happen at any moment, and that’s what worries the leaders of the Fed because banks in the euro zone have invested cash to very large amounts, and they may need to repatriate in distress.

The ECB has very few reserves in dollars and it may at any time be in default of payment in dollars. This is why it has entered into swap agreements with the Fed and other central banks.

Exposition de BNP Paribas à la Grèce : 8,499 milliards d’euros.

Exposition du Crédit Agricole à la Grèce : 27,096 milliards d’euros.

Exposition de BPCE à la Grèce : 1,720 milliard d’euros.

Exposition de la Société Générale à la Grèce : 6,592 milliards d’euros.

Total : les quatre banques françaises sont exposées à la Grèce pour 43,907 milliards d’euros.

Autrement dit : les quatre banques françaises sont exposées à la Grèce pour 63,422 milliards de dollars.

En ce qui concerne La Banque Postale :

La Poste a vu son bénéfice net reculer de 21,2 % à 377 millions d’euros au deuxième trimestre en raison d’une provision de 158 millions d’euros liée à la dépréciation des titres grecs détenus par La Banque Postale, sa filiale bancaire.

Conclusion :

La Banque des Règlements Internationaux, BRI, (en anglais : Bank for International Settlements, BIS) donne les détails dans la table 9E, page 102 :

http://www.bis.org/publ/qtrpdf/r_qa1106.pdf

Grèce :

Prêts des banques françaises au secteur public grec, aux banques grecques, au secteur privé non-financier : 56,740 milliards de dollars.

« Other potential exposures » ( = dérivés, garanties étendues, engagements de crédits) : 8,307 milliards de dollars.

Total : 65,047 milliards de dollars.