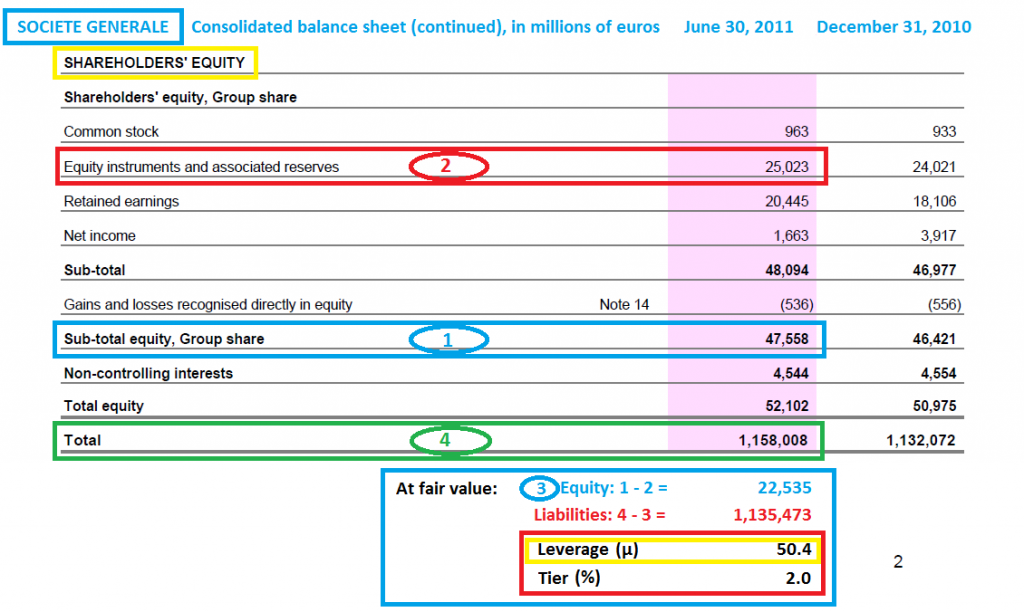

The real leverage of Société Générale is… 50!

Document 1:

Indeed, the French bank counts in its equity item 2: Equity instruments and associated reserves which are actually different forms of liabilities related interests subject to some conditions.

Equity published in item 1: Sub-total equity, Group share should be reduced by Equity instruments and associated reserves (item 2) to determine the true equity at fair value (item 3) i.e. 22,535 billion of euros.

Total liabilities are equal to total assets (item 4) less the true equity at fair value (item 3): 1,135.473 billion of euros.

So, the leverage is the ratio of total liabilities on equity: 50.4 i.e. a Tier ratio at 2.0%.

Société Générale did not respect the rules of prudential borrowing as they were defined by Alan Greenspan.

Document 2:

| SOCIETE GENERALE | 2007 | 2008 | 2009 | 2010 | 2011 Q2 |

|---|---|---|---|---|---|

| Liabilities (published) | 1,052,035 | 1,093,918 | 981,497 | 1,085,651 | 1,135,473 |

| Equity (published) | 27,241 | 36,085 | 42,204 | 46,421 | 47,558 |

| Equity instrument etc | 7,514 | 17,727 | 23,544 | 24,021 | 25,023 |

| True equity | 19,727 | 18,358 | 18,66 | 22,4 | 22,535 |

| µ (leverage) | 53.3 | 59.6 | 52.6 | 48.5 | 50.4 |

| Tier (%) | 1.9 | 1.7 | 1.9 | 2.1 | 2.0 |

The bank cannot lower the leverage below 50 (even, it was at 60 end 2008!).

To be good leveraged, it should increase the equity until 84 billion of euros!

French state should be recapitalized (nationalized) this Gosbank because it is too big to fail with liabilities at 1.135 trillion of euros for an annual GDP of France nearly at 2.000 trillion: 1,300 € per inhabitant (64 million)!

French (and European) banks have adopted rules of leverage at their convenience, which do not correspond to those internationally adopted. For example, they enter in their accounts, in the equity, quasi-equity which are actually liabilities as these Equity instruments and associated reserves.

Click here to read the latest Consolidated Condensed Interim Financial Statements as at June 30, 2011.

Click here to read the website for investors.

This week or perhaps next we shall find out why the shorting ban is in place – SocGen is just one of the Euro TBTF candidates. Now French Mainstreet is going to need to take a very hard look at why the state should prop up the banks.

DANSONS LA CARMAGNOLE!

Merci pour l’analyse..

D’autres tricks que les banques utilisent pour truquer leur chiffre est la survalorisation de leur goodwill (par ex BOfA maintenait encore des milliards en goodwill lies a l’acquisition de countrywide il y a a peine 1 an) voir des deferred tax assets (qui peuvent etre utiles pour une entreprise qui gagne vraiment de l’argent mais pas pour une en perd)

Ca serait bien que tu rajoutes une update la dessus.

Vous pouvez être intéressé par cet:

http://www.liveinternet.ru/users/4114756/post180304306/

Il semble que la Société Générale ait publié un communiqué pour contredire vos chiffres cher JP Chevallier.

http://www.forexcrunch.com/societe-generale-leveraged-more-than-lehman/

So, you are not taking into account these ‘Equity instruments and associated revenues’. This includes the issuing premium, which is the added value (over the nominal value of the shares) on capital increases, so you are implying that SocGen’s capital includes only retained earnings and nominal value of the shares… Why are not you applying the same correction on your BNP ratio? Appart from that, and considering your exquisite treatment of the figures, you must deduct from the total assets the net value of derivatives, like 200 Bn… Please, start by knowing well the basic accounting rules before delivering such an agressive conclusion.

I’m a customer of Societe Generale

I’m wondering what would happen if it was to fail…